Real-Time Synchronization

Syncing your sales, returns, and settlements from e-commerce platforms directly into Tally ensures accuracy and up-to-date records, eliminating the need for manual entries and errors.

In today’s digital world, seamless accounting and GST compliance are non-negotiable for e-commerce businesses. With eVanik’s Tally PRIME Integration, we provide the only one-click integration solution for e-commerce businesses, automating every aspect of your accounting and tax filings. This integration goes beyond syncing sales — it also helps with returns, settlements, commissions, TCS/TDS, and much more.

One-Click Integration, requires no manual effort or heavy lifting of large spreadsheets

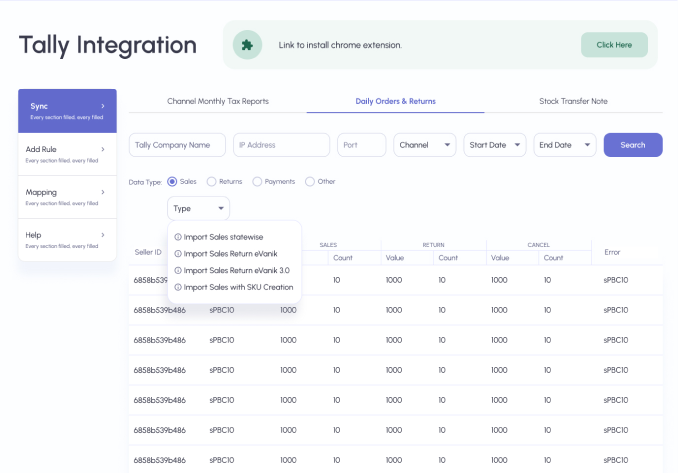

Comprehensive integration of Orders, Returns, Settlements, Commission Invoices, TCS, TDS and Stock Transfers.

Guaranteed matching of data with the MTR / STR reports of marketplace channels

Real time integration of all transactions, customized voucher posting

Easy mapping with your ledgers, products and voucher types

For e-commerce businesses in India, Tally Integration is the backbone for efficient financial operations.

The importance of integrating Tally with your e-commerce platforms cannot be overstated, especially when dealing with multiple marketplace transactions. Here’s why it’s essential:

Syncing your sales, returns, and settlements from e-commerce platforms directly into Tally ensures accuracy and up-to-date records, eliminating the need for manual entries and errors.

As a secondary payment reconciliation layer, eVanik ensures that payments received from e-commerce platforms match your sales invoices and bank transactions, improving financial clarity and accuracy.

With automated synchronization of GST data, eVanik ensures that your business remains compliant with GST laws, making tax filing faster and more accurate.

Whether you need individual transaction entries, state-wise bulk entries, stock transfer notes, custom ledgers, or product mapping, eVanik offers complete customization to fit your business needs.

With just one click, enable Tally PRIME integration to sync all your e-commerce data into Tally.

Synchronize inventory across all channels to reflect accurate stock levels.

Ensure accurate reconciliation by matching the payments received from major platforms.

Once integrated, eVanik syncs your GST data directly with Tally, ensuring compliance with tax laws and simplifying tax filing.

eVanik offers seamless integration with multiple e-commerce platforms — Amazon, Flipkart, Meesho, Myntra, Jiomart, Shopify, AJIO, and more.

Automate your GST filing process, ensuring that your business remains GST compliant across multiple marketplaces and transactions.

Say goodbye to manual entries and data reconciliation errors. eVanik automatically syncs your e-commerce transactions into Tally in real-time.

We offer comprehensive customer support to guide you through every step of the integration process.

eVanik provides integration with major e-commerce marketplaces, ensuring that all your transactions are automatically synced with Tally, no matter where you sell

The Tally integration in eVanik acts as a secondary payment reconciliation layer, automatically reconciling payments received from different platforms with the corresponding sales invoices.

With eVanik, you can automatically generate and sync state-wise bulk entries for all your transactions, ensuring that your GST filings are accurate and up-to-date for each state.

Sync stock transfer notes seamlessly between warehouses to maintain up-to-date and accurate inventory records in Tally.

Create and manage custom ledgers and voucher types that suit your business needs, ensuring that your accounting system aligns with your unique business structure.

Effortlessly map products and SKUs between your e-commerce platforms and Tally to maintain consistent naming and ensure accurate entries.

It automatically records sales, returns, and payments, ensuring accurate tax calculations for platforms like Amazon and Flipkart. To enhance your Tally integration experience, install our Chrome extension by clicking here: